The term “financial data” covers everything from daily transactions to complex data like market movements, economic indicators, and company performance. Organizations actively collect and analyze these data to predict trends and make more informed decisions, gaining a competitive edge and staying ahead of their competition.

In the modern world, where everything is either automated or running on a virtualized system, the data generated by these financial systems is in the scale of petabytes or even exabytes in some cases. Storing and analyzing this data within traditional solutions becomes impractical due to the specific regulations and use cases that must be achieved.

This is where financial data infrastructure platforms allow organizations to aggregate, analyze, and deliver financial data from multiple sources, providing users with insights, analytics, and tools for informed decision-making.

What is a Financial Data Platform?

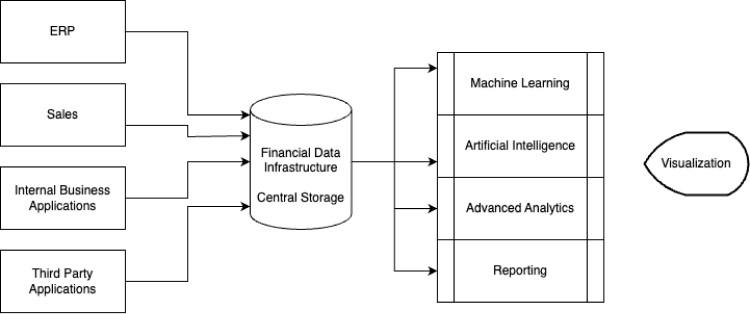

A financial data platform is an integrated system that allows organizations to collect, analyze, and report on financial data from multiple sources, such as stock exchanges, regulatory filings, news outlets, ERP solutions, sales platforms, and more.

Since different platforms and vendors use their own formats for storing data, financial data platforms help organizations by normalizing and standardizing this data, ensuring that data from various sources can be seamlessly analyzed and used for informed decision-making. Furthermore, these platforms can aggregate data into a single pane, allowing users to access data from across the organization within a single platform while scaling up with the increasing demand as the organization grows.

Since stolen or leaked financial data can directly impact any organization, the security of these platforms is of the utmost importance. This includes encrypting data and enforcing strict access control to implement the principle of least privilege.

The Importance of Financial Data Infrastructure

While we understand that financial data is being used in many instances within an organization, the following can be considered as some of the more prominent use cases:

Data-Driven Decision-Making

Financial data infrastructure provides the foundation for data-driven decision-making, allowing real-time and historical data access. This access enables decision-makers to gain an in-depth knowledge of market trends, customer behavior, and business performance, enabling them to make informed and strategic decisions.

Some use cases from financial institutions include:

- Portfolio management: Investment firms utilize real-time market data and historical performance metrics to optimize investment portfolios, efficiently allocate assets, and maximize client profits.

- Strategic planning: Banks and financial institutions use data analytics to uncover market opportunities, evaluate competitor strategies, and create strategic initiatives for corporate growth.

- Risk assessment: Insurance firms use historical claim data and market trends to evaluate insurance risks, determine premium rates, and create risk management strategies for safeguarding against potential losses.

Risk Management

Organizations may use predictive analytics and scenario modeling approaches to foresee potential risks, assess their impact, and apply proactive risk management measures to protect assets and minimize losses.

For example, predictive analytics can be used to forecast market trends, evaluate credit risk, and detect possible financial vulnerability. By studying past data and detecting patterns, they may predict and prevent future risks.

Similarly, modeling enables organizations to simulate numerous hypothetical scenarios to analyze the possible impact of negative incidents on financial performance. By investigating various situations and their repercussions, organizations can reduce possible losses.

Compliance and Regulatory Requirements

A robust financial infrastructure helps organizations comply with regulations and reduce the risk of noncompliance by ensuring data accuracy, maintaining complete audit trails, and implementing robust data governance standards.

While meeting compliance and regulatory requirements is essential, financial data platforms provide real-time data validation and consistency checks, ensuring reliability and preventing misreporting to ensure data accuracy.

Also, these data platforms log all data changes, making it easy to trace transactions and identify who made specific changes. Adhering to audit trail requirements enhances security and deters fraud.

They also support data stewardship, enforce access controls, and implement policy rules, maintaining data quality and security to maintain acceptable data governance practices across all operations within the platform.

Innovation and Competitiveness

Financial data platforms enable organizations to drive product and service innovations by analyzing customer data and market trends to create new, tailored products and services that meet emerging needs. They can also allow organizations to utilize advanced analytics that help anticipate market trends and customer behavior, thus enabling proactive innovation.

Organizations can also benefit from detailed market insights to identify opportunities and threats, inform strategic decisions and market entry strategies, and facilitate precise customer segmentation. This leads to targeted marketing, improved customer service, and efficient resource allocation.

Financial data platforms are popular use cases for helping organizations remain competitive, including dynamic pricing models, enhanced customer experience, and customer lifetime value (CLV) analysis.

Data Peace Of Mind

PVML provides a secure foundation that allows you to push the boundaries.

The Role of Financial Data Analytics Infrastructure

Data analytics drives all major organizational decisions, most happening within financial data platforms or systems.

Here are some popular scenarios for when organizations use financial data analytics infrastructure:

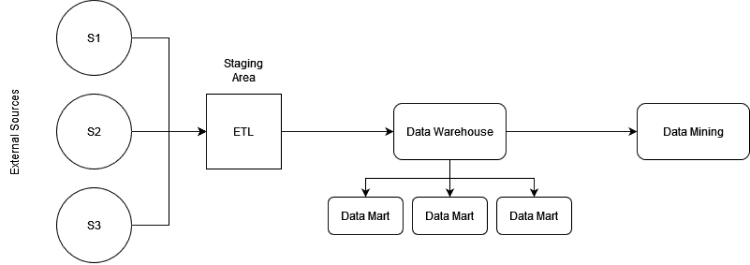

1. Data Warehousing

Data warehousing is essential for storing and organizing large volumes of financial data, making it accessible for analysis and reporting. A well-designed data warehouse consolidates data from various sources, ensuring consistency and accuracy. Data architecture and modeling are critical in this process, as they define the structure and relationships of the data, enabling efficient querying and data management. This setup supports complex analyses and helps maintain data integrity across the organization.

2. Business Intelligence

Backed by the data collected by the financial data analytics infrastructure, Business intelligence (BI) tools transform raw financial data into actionable insights. These tools extract, process, and analyze data to provide meaningful insights that support strategic decision-making.

Data visualization and reporting are key components of BI, as they help present data in an easily understandable format through charts, graphs, and dashboards. Effective visualization and reporting enable stakeholders to grasp insights quickly, identify trends, and make data-driven decisions.

3. Machine Learning and AI

Machine Learning and AI technologies can reveal hidden patterns and trends that traditional analysis methods might miss. Predictive analytics uses Machine Learning algorithms to forecast future market trends and customer behavior, helping organizations to anticipate changes and plan accordingly.

For example, Fraud detection systems leverage Machine Learning to identify unusual patterns and behaviors, enabling real-time detection and preventing fraudulent activities. Additionally, algorithmic trading employs AI to analyze vast amounts of data and execute trades at optimal times, enhancing investment strategies and improving financial returns.

Key Components of Financial Data Platforms

Financial data platforms consist of various components. Here, we look at some key components that operate as the core components within these platforms.

1. Data Sources

Data sources are the foundation of financial data platforms, encompassing various sources such as transactional, market, customer, and external data feeds. These sources provide the raw data necessary for analysis and decision-making.

2. Data Storage

Data storage involves the infrastructure and mechanisms for efficiently storing and organizing vast amounts of financial data. This includes relational databases, data warehouses, data lakes, and cloud storage solutions, ensuring data accessibility, scalability, and security.

3. Data Processing

Data processing effectively combines procedures and algorithms to transform raw data into actionable insights. This involves data cleansing, transformation, aggregation, enrichment, and preparation for analysis and reporting.

4. Analytics and Reporting

Analytics and reporting are the final stages of the data lifecycle, where insights are extracted from the processed data and presented in a meaningful format. This includes descriptive, predictive, and prescriptive analytics, visualizations, dashboards, and reports for decision-makers.

Benefits of Financial Data Platforms

Using financial data platforms has very evident benefits for any organization:

- Improved decision-making: Financial data platforms provide timely access to accurate data, enabling informed decision-making across all levels of an organization.

- Enhanced risk management: These platforms facilitate robust risk management by providing insights into market trends and portfolio performance.

- Regulatory compliance: They ensure accurate reporting and maintain comprehensive audit trails, helping organizations comply with regulatory requirements.

- Innovation and competitiveness: They also drive innovation and enhance competitiveness by enabling data-driven insights and analysis.

Conclusion

In conclusion, financial data infrastructure is the backbone of modern finance, enabling organizations to thrive in a data-driven world. The benefits of implementing a financial data platform are countless, from improved decision-making to enhanced risk management and regulatory compliance.

As organizations evolve to be more resilient and competitive to meet their customers’ demands, data analytics plays a vital role in ensuring they can keep up and remain competitive. Therefore, financial data infrastructure has a more crucial role in an organization than ever.